A Young Boy Teaches His Father About Financial Planning

Mr. A has a son and his name is Ah Boy. Ah Boy has a bad posture, which requires regular visits to a chiropractor. Although Mr. A has been taking Ah Boy for treatment and encouraging him to do daily core muscle exercises, the chiropractor suggests a more intensive rehabilitation that comes with a higher medical fee. Mr. A is upset and stressed because of the current economic situation and higher inflation impacting his household expenses. However, he doesn't want to burden his son with his frustration.

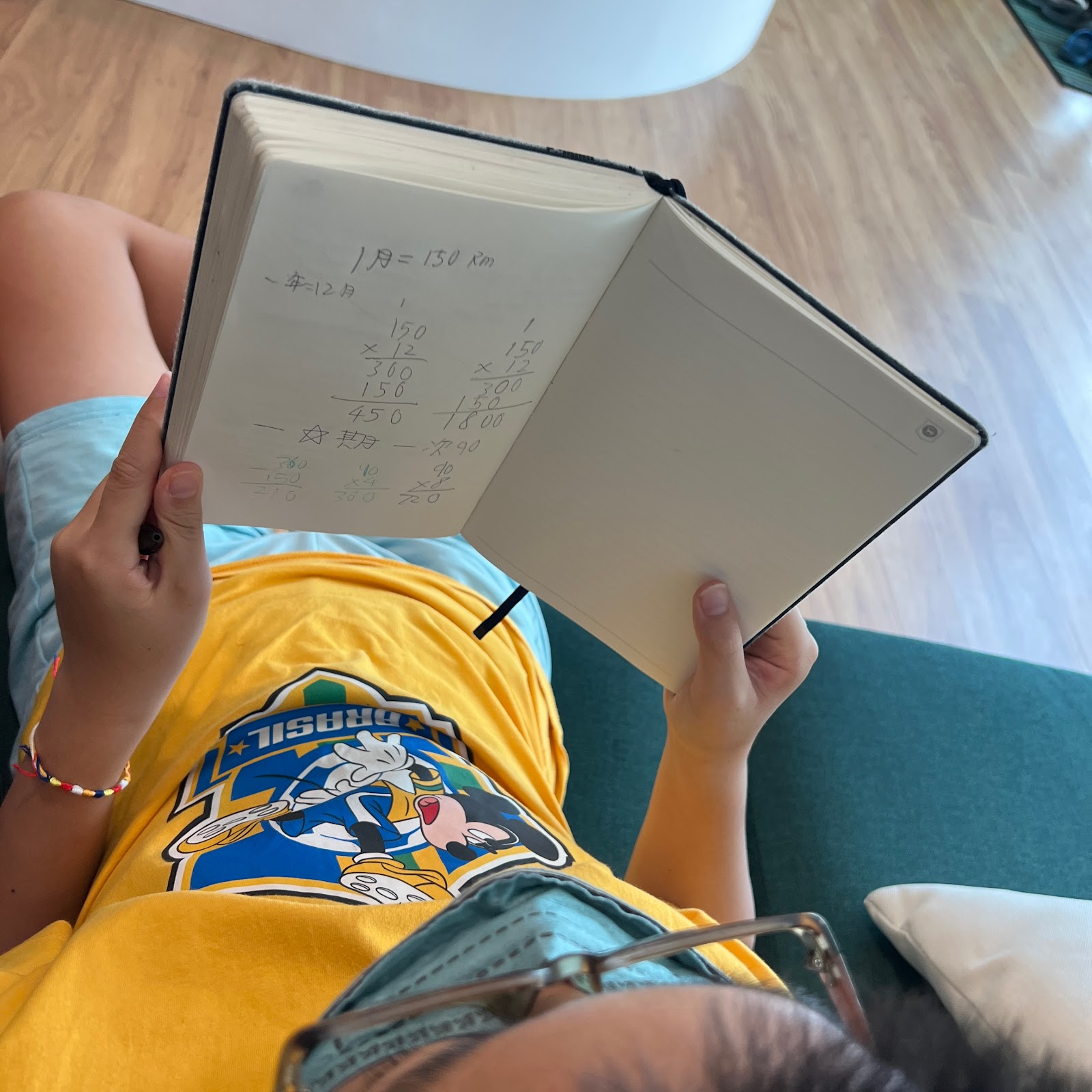

Mr. A takes this opportunity to involve Ah Boy in financial planning by asking him to calculate how much they need to spend on treatment every month. Ah Boy realizes that the intensive rehabilitation will cost them a few hundred dollars more each month. To avoid the additional expenses, Ah Boy promises to practice the core muscle strength exercises regularly at home, which will make him stronger and better.

If you are facing a similar situation, whereby your expenses are increasing faster than your income, here are some practical ways to handle financial challenges:

Reduce Expenses:

Take a closer look at your expenses and identify where you can make cuts. You can start by differentiating between needs and wants. If you are driven by marketing ads and promotions, most of the time, that is a luxury expense. Try to reduce your spending on such items. For example, instead of eating at an expensive restaurant, try cooking at home. Instead of going to the movies every month, go every two months. By reducing your expenses, you can create a positive cash flow every month.

Increase Income:

To increase your income, you can look for better career opportunities, start a small business, or engage in part-time work. This will require some planning and effort, such as updating your resume, networking with people in your field, or learning new skills. However, increasing your income is a longer-term strategy that can have a significant impact on your financial situation.

Financial planning is a vital skill that is not often taught in schools. It is up to us as parents to educate and instil good financial behaviour in our children. By involving our children in financial planning and decision-making, we can help them develop practical skills and a positive attitude towards money management. By reducing expenses and increasing income, we can handle financial challenges and achieve our financial goals.

Comments

Post a Comment