Studying Hard vs Financial Planning

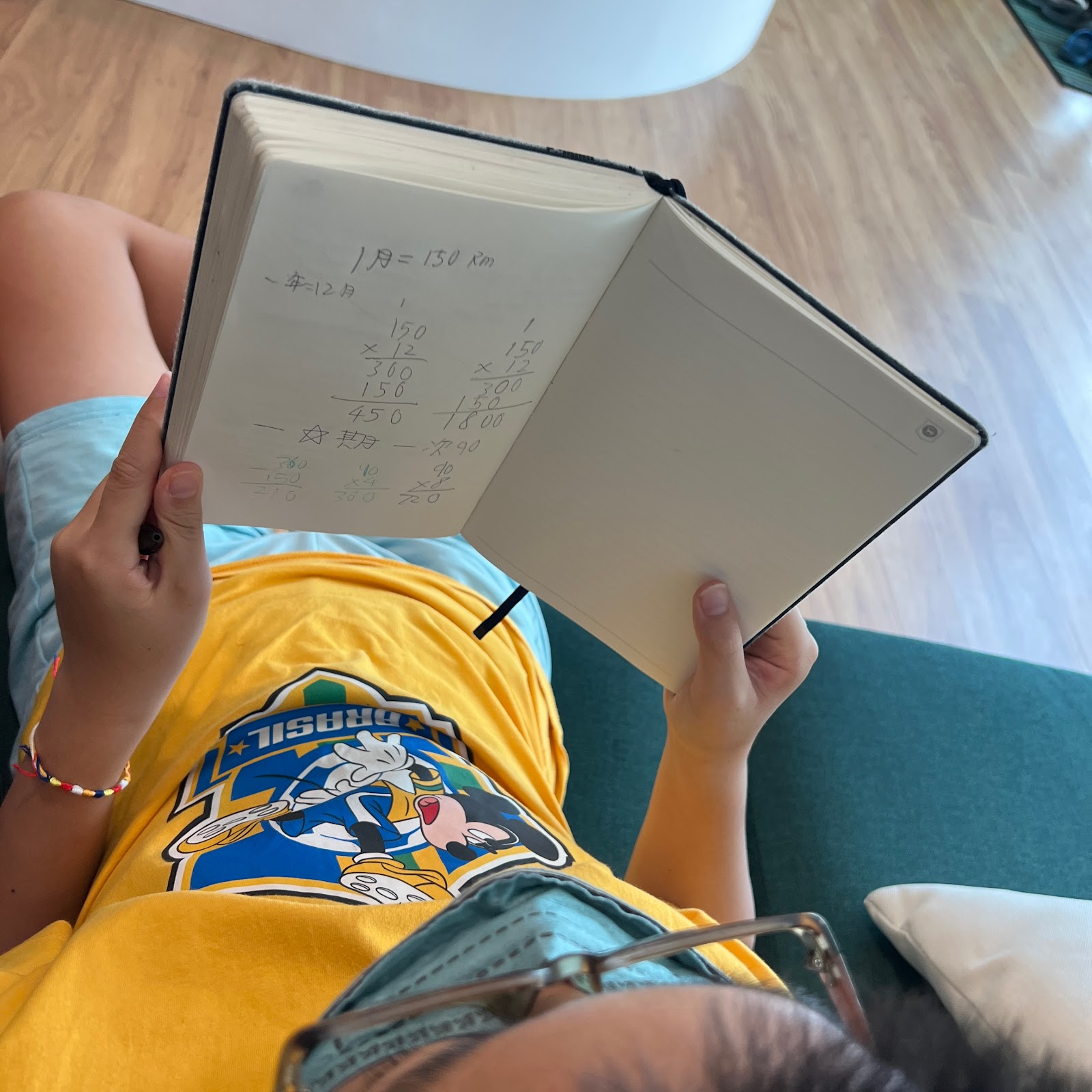

I recently had a conversation with a university friend whom I hadn't met in 25 years. During our conversation, my friend, who has two children, mentioned an intriguing question asked by one of their children: "Why should we study so hard when the government approves a minimum wage starting at RM 1,500 per month?" My friend was stunned by this question, and I couldn't help but smile. Determining Your Future Salary The real question to ask is, "How much will be your last drawn salary if you start with RM 1,500 per month now?" Let's assume you begin working at age 20 and plan to retire at age 60, giving you 40 years of working life. For the sake of simplicity, we'll assume a permanent annual salary increase of 4%. The answer is that your last drawn salary upon retirement at age 60 will be RM 7,201.50 per month! In contrast, considering an article that suggests a fresh graduate's starting salary will be RM 2,500, and assuming a permanent increase of