The most value for money medical insurance in Malaysia

In this post, I am not talking about the best product nor the cheapest product. The best product is the product that works when you need to use it. The reason (for those who can afford it) will pay a higher premium price for certain goods and services because the consumer wants to ensure the product will work!

In this post, I will point out that at this moment, based on surface-level research, this is my comparison and my findings. If you have a different opinion, please leave your comment and we can discuss it.

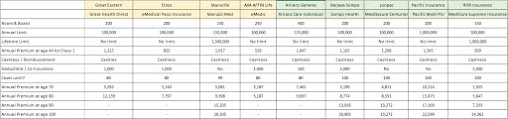

Refer to my previous post, I listed almost 32 medical insurance that you can purchase in Malaysia. Then I perform my personal selection based on my current needs and present to you 9 companies with 9 products. Please remember there are much more benefits and features to be compared in each product, for example, some products do provide outpatient kidney dialysis with a limited amount but some products do not have a limit for this benefit. The comparison is ONLY focused on Annual Limit, Lifetime Limit, Deductible or Co-Insurance and maximum age.

If you expecting me to tell you which one is the "best" medical insurance, then I have to disappoint you in this post because I will not do so. As I mentioned, there is no such product exist that can be called the best medical insurance.

Refer to the table above, assuming these are the only 9 plans that available for you, which one will you choose and can I know why?

Once again, this is my blog. If you like my post please share and follow my social media and this blog. Thank you!

Comments

Post a Comment